Streamline Finance Operations with RPA: Transforming Finance Industry Services

Challenges and Our Solution

The finance industry faces complicated challenges such as sophisticated legacy systems, strict regulatory requirements, and changing client needs. These factors can hinder operational efficiency and increase the risk of errors in manual processes like data input, reconciliation, and reporting. Companies need to streamline finance operations with RPA and we have just the solution.

Matacs’ Robotic Process Automation (RPA) solutions can address these challenges by automating repetitive tasks and streamlining compliance procedures. Our services enhance financial efficiency using robotic process automation, reduce errors, and increase output, allowing financial institutions to focus on meeting client needs and regulatory demands more effectively.

The "WHAT" of RPA in Finance

Robotic Process Automation (RPA) in finance introduces a transformative approach to managing routine tasks that are traditionally handled by human resources. At its core, RPA employs intelligent software robots to automate tasks such as data entry, transaction processing, and financial reporting. These robots work by interacting with existing financial systems to execute predefined processes with high precision. For instance, RPA can automatically update financial records, process transactions, and generate reports based on set rules, which helps in maintaining accuracy and consistency across various financial operations.

By integrating RPA into finance, organizations experience a shift in how these tasks are performed. Instead of manually handling repetitive activities, financial teams can rely on RPA to ensure that tasks are completed efficiently and according to established protocols. This automation provides a streamlined approach to managing financial workflows, allowing finance professionals to leverage the technology for handling complex tasks and improving overall process management.

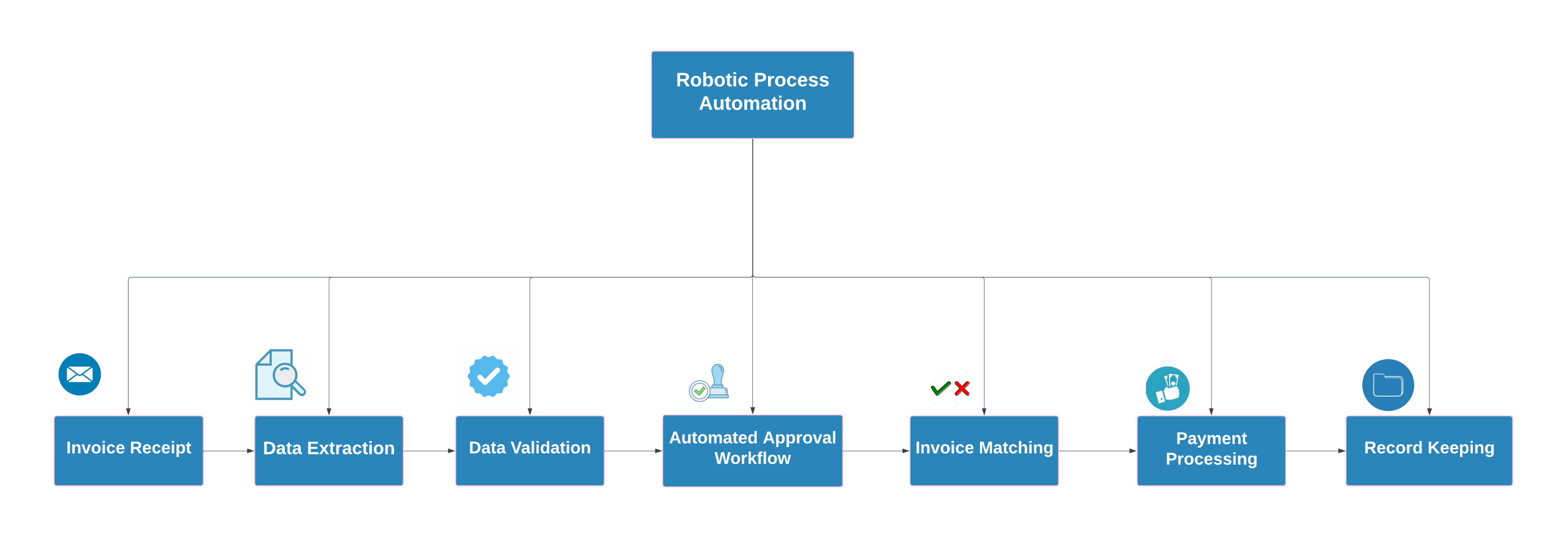

RPA in Action: Visual Demonstration

In invoice processing, RPA starts by automatically capturing invoices received through various channels like email or EDI. Using Optical Character Recognition (OCR), RPA extracts key details such as invoice numbers, dates, and amounts, transforming the data into a digital format. The extracted data is then validated by cross-referencing it with purchase orders and contracts to ensure accuracy and identify any discrepancies.

Once validated, RPA manages the automated approval process by routing invoices to the appropriate approvers, sending notifications, and tracking responses. After approval, RPA matches the invoice with purchase orders and delivery receipts to confirm alignment and compliance. With everything in order, RPA handles the payment processing, scheduling and executing payments according to the invoice terms.

Finally, RPA archives the invoices and related documents in the financial records system, ensuring secure storage and easy retrieval for future reference or audits. This comprehensive automation not only speeds up the process but also enhances accuracy and efficiency throughout the entire invoice processing workflow.

What you gain with Matacs RPA Solutions

When you choose Matacs, you’re partnering with a team dedicated to transforming your financial operations through advanced RPA solutions. Our automation technology helps eliminate errors and ensures you stay compliant with regulations, making your processes more accurate and efficient. You’ll benefit from faster transaction processing, real-time updates, and better insights into your financial data, all while reducing costs. Matacs is here to streamline your workflows and protect your sensitive information, so you can focus on what matters most.

Use Cases for RPA in Finance

Account Reconciliation

Invoice Processing Automation

Expense Management

Financial Reporting Automation

Our RPA bots can automate the generation of financial reports by extracting data from disparate sources, performing calculations, and formatting reports according to predefined templates. Moreover, they leverage RPA to streamline financial workflows, where bots ensure the accuracy and consistency of financial reports while reducing the time and effort required for manual report generation.

Overcoming Implementation Challenges

Integrating RPA into the financial sector can be complex due to the intricacies of financial systems and the need for high-level data security. Financial institutions face challenges such as integrating RPA with legacy systems that may not be designed for automation, ensuring accurate data synchronization across various platforms, and navigating strict regulatory requirements. Additionally, there can be significant hurdles in managing the transformation process, including overcoming employee resistance and adjusting to new workflows.

Matacs provides tailored solutions to streamline finance operations with RPA and to tackle these specific challenges in the finance industry. Our expert RPA developers are adept at seamlessly integrating automation tools with your existing financial systems, ensuring compatibility and enhancing overall functionality. We specialize in safeguarding data integrity and compliance by implementing robust security measures and adhering to regulatory standards. With Matacs, you benefit from a customized approach that addresses your unique needs, minimizing disruption and maximizing the effectiveness of your RPA implementation.

How Robotic Process Automation (RPA) is Revolutionizing the Finance Industry

RPA automates repetitive tasks like data entry and transaction processing, reducing errors and speeding up operations, allowing staff to focus on strategic tasks.

Challenges include integrating with legacy systems, ensuring data accuracy, managing compliance, and addressing resistance to change.

Matacs provides seamless integration, customization, and ongoing support to ensure smooth RPA implementation and optimize financial processes.

RPA can automate invoice processing, account reconciliation, transaction monitoring, and financial reporting.

RPA ensures compliance by automating tasks with built-in validation and audit trails, maintaining consistent adherence to regulatory rules.

RPA delivers high ROI through increased efficiency, reduced errors, and lower operational costs, often outweighing the initial investment.

Success is measured by improved accuracy, faster processing times, cost savings, and efficiency gains through key performance indicators.

Book Your Free Consultation

Please fill out the form below and we’ll get back to you to schedule free 30-min initial consultation.